What is a Roth 401(k) and is it right for you?

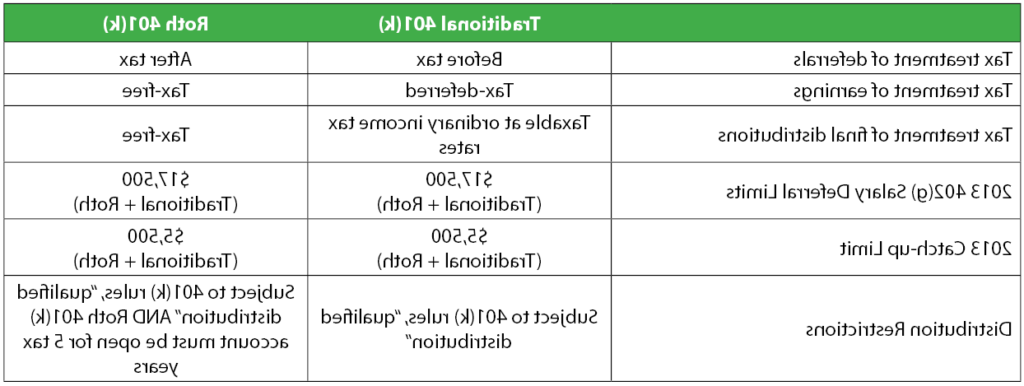

S&K offers our eligible employees the option to select a Traditional 401(k) or Roth 401(k) retirement plan. Which one is right for you? Here’s a quick comparison of the two retirement plans.

Elective deferral contributions (from your paycheck) to a Traditional 401(k) retirement plan are contributed on a pre-tax basis and help lower your current taxable income. Roth elective deferral contributions, however, are much like a Roth IRA in that contributions are made on an after-tax basis.

Money in the Roth account and earnings will be distributed tax free if withdrawn after age 59½, death, disability, AND after the end of the five-year taxable period during which the participant’s deferral is first deposited to the Roth 401(k) account (aka the Five Year Rule).

A Roth 401(k) account can be rolled over to another plan that permits Roth 401(k) contributions or to a Roth IRA. If rolled into a Roth IRA, the tax-free nature remains and the money is not subject to the minimum distribution requirement at age 70½ as in the Roth 401(k).

Who Would Likely Benefit from a Roth 401(k)?

- People who believe taxes will be greater in the future

- Young investors who believe they will be in a higher tax bracket in the future

- Investors who do not qualify for the Roth IRA due to income limit

- Low income investors who are tax-exempt

- Investors who use Roth 401(k) as a planning tool in conjunction with traditional 401(k) plans

- Participants looking to “hedge” against risk of higher future tax rates

Who Would Likely NOT Benefit from a Roth 401(k)?

- People certain that future tax rates will decrease

- People expecting to experience significant drop in income upon retirement

- People with high temporary income

- People needing access to their funds within the first 5 years of deferrals

This comparison chart is based on information provided in 2013. Consult your financial adviser before making changes to your retirement plan.

In summary, Roth 401(k) contributions have potential to allow individuals more flexibility in saving for retirement, whereby giving investors more control over the taxable alternatives. Employees are encouraged to contact our advising company; 401(k) Advisors, Inc. to discuss your personal needs and goals. Their expertise is the best way to start weighing the pros and cons of each option.